Let’s discuss one case study just recently planned.

The basic information gathered was Mr Santosh, age 35, is in service for the last 8 years and is settled in Thane with his wife and a cute little son, 6 years old Ameya.

His wife Priyanka is also working in a medium size firm.

His parents are at his native place and staying with his brother.

The assets at his native place cannot be considered in his net worth as they won’t be liquidated.

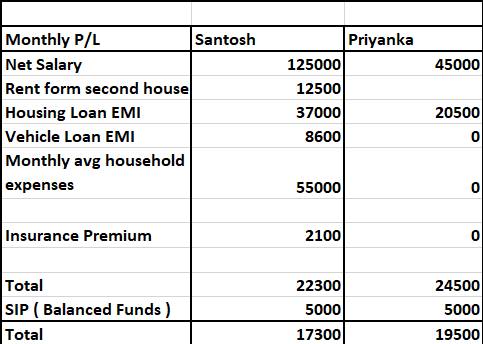

As of now, the Housing loan outstanding for the thane house is Rs 45.00 lacs with an EMI of Rs 37000/-.

He has also invested in some residential property at Karjat with a housing loan in his wife’s name. The Present Outstanding loan is 25.00 lacs with an EMI of Rs 20500/-

He is also having a life insurance policy of 20.00 lacs and mediclaim through the office of Rs 10.00 lacs as a Family Floater.

His Financial Goals are:

1. To retire at the age of 55 and join NGO for social work.

2. Priyanka wishes to quit the job in 10 years to take care of Ameya’s studies.

3. To accumulate enough corpus to take care of Ameya’s graduation and post-graduation.

4. To maintain the standard of living after retirement at the age of 55.

So what do you think he should do?

The Solution

We had 2 to 3 meetings before finalizing the future financial plan and jotted down the actions that needed to be taken. I was very happy to see that, they had an open mind and trust to go ahead with the plan. After a lot of deliberations, we arrived at certain anomalies. To have any solution, we should first understand the problems and analyze them to the fullest.

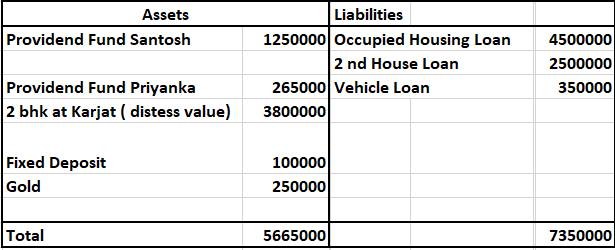

- Asset Liability mismatch was very high and that needed to be brought at par and in control.

- His Health insurance depended upon the continuation of his job. But in case of losing a job or changing career, He has no alternative to secure health risks.

- Life insurance was inadequate to mitigate the risk. Your life insurance cover should be enough to take care of your dependent for a future period, it requires the calculation of cash flows needed to keep the family going in case of any eventuality.

- There was no concrete plan for his desired goals, which he had shared in the first meeting.

So, looking at the current position, we zeroed down some action plans.

1. Secure his risk first by taking floater health insurance and additional life insurance (only term plan) from any insurance company, he is comfortable with.

2. Dispose of the second property and bring the Asset Liability well in control.

3. This will free up additional funds and cash flow to take care of his future goals.

4. We planned investments as per his risk profile.

5. We created a contingency fund to take care of his household expenses for at least 12 months.

6. We prepared a cash flow for the next 20 years matching inflows and outflows. This cash flow statement was done taking into consideration his financial goals as desired by him. These cash flows also took their current lifestyle into consideration. Santosh and Priyanka agreed to stick to the plan. Will this plan work?

Definitely, but it also requires a review at least 2 times a year at the initial stage. I wish both Santosh and Priyanka, All the best for their future and admire their willingness to bring and keep their financial position on the track.

I will request each one of you to prepare a comprehensive and practical financial plan for your family as early as possible. Please consult any competent and qualified person without any delay. If you need any support from me, I am just a phone call away.

The Results

In the case of Santosh and Priyanka, their existing portfolio was reviewed and modified to suit their goals and better financial position. Now, their Asset Liability position has improved to 1.30 from 0.75 and net cash outflow has been reduced for building new cash-generating assets.

Knowingly or unknowingly, we build our portfolio over the years based on inputs from various sources and continue without analyzing it every year. Is it so difficult to spare a few days at the end of every financial year to review your financial position? Do you find out answers to the following questions in April or May, while collecting a lot of data for filing income tax returns?

1. What is my Asset Liability position?

Have my assets given returns above inflation? Or Liabilities are bleeding my cash flow?

What is my Asset Liability ratio?

2. How much of my net income goes into paying debt? (Principal and interest).

3. Do I need to readjust my portfolio to keep my financial position on track given major changes in the economy?

4. Do, I feel pain in my wallet every last week of the month and severe pain in the month of March while paying taxes and insurance premiums?

If answers to these questions make you feel very uncomfortable, then it’s time to review your portfolio and take corrective action immediately.

Portfolio management is the process

of selecting, monitoring and adjusting a collection of investments to achieve a specific financial objective.

Portfolio management aims to optimize the return on investment while minimizing risk. Portfolio management can be done by individuals or professional portfolio managers who manage client portfolios. Portfolio management also involves Risk Management.

Portfolio risk is the potential for loss due to a change in the market conditions or the performance of individual securities. Managing portfolio risk involves assessing the different types of risks and taking steps to minimize them.

You may connect me to review your existing portfolio and plan it better.