Financial planning sounds like a technical skill to many of us who are only familiar with the basic concepts of savings, FDs and at most, mutual fund investments.

Even though I was a banker, I didn’t approach the topic seriously until my retirement age dawned and I realized how important it is to spend time organizing your money life in order to have peace in your personal sphere.

Here’s the story of how I made that change. I hope it illuminates, entertains and informs you.

For any friendly advice, I’m always available at regebs@gmail.com so don’t be shy! And if you found value in this story, do share it with your family and friends…

Chapter 1

It has been 2 years since I plunged into early retirement after saying, “Enough is enough.”

I had been planning to move out of the corporate race for three years but was still shaky on whether it was a good time to follow through on that instinct … and I took it anyway.

For the last few months, my ex-colleagues have been asking me for the source of my courage. I can understand why they’re curious because I had gone through the same dilemma at one point too. To allay some of my doubt, I remember calling on an old friend, who also had taken early retirement and had moved on. When I asked him the same question, his reply was illuminating…

“If you keep asking such questions to others looking for an easy answer.. You will never make that decision. Don’t go around finding a Holy Grail for your worries. This is one of those things in life that you have to find yourself …

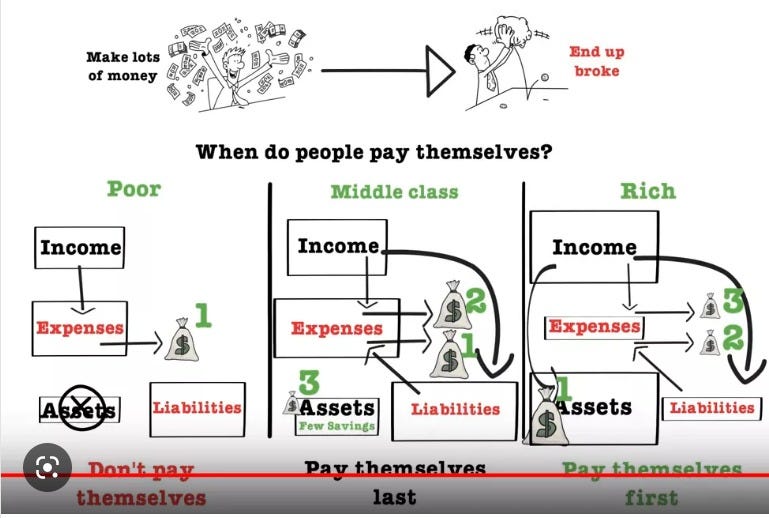

Every individual has a different psyche and perspective toward life. I know every Tom and Harry has read the book: Rich Dad and Poor Dad. But how many have tried to seriously implement those strategies? It’s good to read and get excited. It’s like a movie, you come home charged up with thoughts of being the same Hero character of the movie.

But everything gets fizzled out soon and you are back to the same routine. You are a Banker, Don’t you know about the cash flow statement, Assets, and Liabilities? It’s as simple as that.”

The most burning question I wanted to clear up was how much survival capital is needed to hang on boots.

He asked me to guess first, “How much do you feel, you should have?”

I shook my head in confusion, hesitantly coming up with a random figure. “Will 5 CR be enough to maintain our same standard of living and complete all future responsibilities towards my family?”

He prodded again, “Why not 8 CR or 2 CR for that matter?”

After sensing my hesitation, he cut to the core question, “Why do you really want to call it a day for your banking career, anyway? That prompted the standard reply from me…

“I am fed up with this job. Work pressure is killing me. It’s not only family life, but my health is also now getting affected. There is a lot of politics in the office. There is a lot of humiliation and injustice…” and so on…

How many of us have the same feelings but continue with all this? He laughed and asked me, “If it’s that bad, then why are you still continuing?”

I explained that it would be a huge risk for me, to let go of all that stability, no matter how detrimental it was to other parts of my life.

Like many others in my position, I just didn’t feel prepared.

He said he understood what I meant and urged me to join him for a simple exercise.

Start asking the same question to your colleagues and try to get as many reasons (not using the word “excuses” here) as possible to know why they are still continuing in their job. Try to have the sample size restricted to employees, who are always cribbing and cursing their Bosses, Management, or for that matter the nature of the job.

It was a little time-consuming exercise, but trusting his judgment, I went ahead. Many times, it was just a casual discussion or sometimes a serious plan made over late evening parties. Needless to say, such plans always used to get vaporized in the early morning con. calls.

I shared all the feedback with the guy. Along with him, we could classify the employees who want to quit but have not been doing the same.

The first set of them were EMI employees. They were carrying huge Mortgages along with car loans, personal loans, Educational loans, and loads of other liabilities like huge credit card dues. The disturbing part was that Mortgages were not only for their occupied houses but also for that second dream home.

What must’ve made them push themselves into such a concerning corner? I think a lot of us like to show off and elevate our standard of living for the sake of status.

It’s like a “Honey Trap” luring you into getting loans at discounted rates to enjoy life and over time, you start accumulating Liabilities. At this point, one could argue about buying property as an Asset and not a liability. But that is an entirely different subject and may need a lot of deliberation.

To keep things simple, I request you to calculate the return of rent on the market value of the house; considering all factors like Tax, Maintenance, Brokerage, and stamp duty. Not to forget, efforts are needed to find a new tenant every time old tenants move out. You may also calculate annualized returns due to appreciation in the property over other sets of Assets.

Similarly, buying a swanky car, which is actually a depreciating asset may not be the right decision at all. I can recall buying a Honda City and keeping it in a parking slot for most of the time due to the paucity of time. It’s the worst nightmare commuting in & around Mumbai from the suburbs to the town office. For that matter, I still recall and laugh at myself, for purchasing a 2 BHK flat as a second home, a few years back.

Bemused by all these crossroads, I immediately asked my friend, “So are you implying that we should give away our dreams and live a simple life?”

He clarified, “Imagine, you are leaving your home situated at a prime location travelling in a high-class car to the office and attending that Review meeting. This is the kind of meeting where your boss just tells you: ‘You are useless and need to perform better.’ You are surprised, as you are one of the better performers but not in Boss’s good books. Now, you either must have skills to please him/her or have that thick (insult-proof) skin.

Your options are either Self-Respect or a High standard of living. In retrospect, I don’t fully blame the Bosses as they too have been humiliated in public by their Bosses. So they just pass on the heat. It’s a Merry-go-round Corporate game.

You think you are good at fooling your Boss, and on the other end of the loop, the Boss thinks he is better at fooling you to get work done as per his requirements. Of course, many of the people stuck in such loops want to truly escape it but end up reinforcing it by taking on more and more debt,” my friend said.

So the crux of the matter is that the whole subject of personal finances is not about simply surviving to meet your needs but also about living with dignity. Unfortunately, as per my friend, this set of people has neither the ability to grow thick skin nor master the skills of appeasing bosses and the smartest in office politics.

“Then what is the solution for those who are already in such deep sh*t?” I asked him. He poked at me and asked whether I was referring to myself, and I returned his smirk.

To be continued…

Chapter 2

My friend and I had begun our personal little study of why most employees are eager to break free from the corporate maze, and one of the groups we identified was those who were struggling because of the debts their lifestyle had brought upon their lives.

But before we could try to find a solution for that first set of employees, let’s look at the second set of employees.

These are the hypnotized folks. They have never thought of quitting and are ready for that Rat race on a daily basis. They are highly motivated and feel humiliation and hurting statements of superiors are simply routine, as in a traditional part of their job.

The moment they feel depressed, they start pounding harder. They are always ready to prove themselves to their superiors. Doing a great job is not a sin, but when it comes to returns on investment of time & energy, is it really worth it?

I remember long back when one of the senior functionaries had visited our region, he gifted me a best-selling motivational book for outstanding performance in selling Mutual Funds.

The commission received by the company was exponentially higher than the increment I got that year. The best part was that he autographed that Book and told me to send a photograph to our private Managers’ group without fail. His real agenda was that more people would get geared up after seeing the possibilities of success and would try to excel in their performance.

Here we see the second-best motivational technique after humiliation, which is creating jealousy among peers and promoting unhealthy competition. One of the physical manifestations of this tactic is the Bell Curve used by corporate organizations. If the purpose of the motivation is to create healthy competition, then it is great. But unfortunately, this mindset often leads to malpractices and mis-selling (most prominent in Sales Jobs).

I remember in one of the Review meetings, the boss categorically said, “It’s a jungle out here, if you are a deer, then you must outrun the Lion to save yourself. And, if you are Lion, then you need to outrun the deer, as it’s at the lower end of your food chain and if you don’t catch the prey, then you will die out of hunger.”

Whether you’re struggling with debt or blinded by the power tactics used by your bosses, all of us become rats racing toward the vicious “Honey Trap.”

I have seen true friends backstabbing each other just to become their boss’ close confidants and informants. Interestingly enough, I remember how one of my peer friends used to deliberately speak in front of such spies about things that he wanted the boss to be informed of. He had identified such spies and used them to take advantage. Eventually, all of these con artists get trapped. They become used to that life and always dream about getting to a certain level in the hierarchy, mistakenly thinking that they will relax after promotion.

But to their detriment, as they rise in the position, they become even more vulnerable, alone, and insecure. They develop a “FLOP” complex i.e. Fear Of Losing their Official Position. In other words, they start developing an addiction to being authoritative. The power that they get by virtue of their position is something that they misuse to play with the careers of subordinates, and their authority to humiliate and question others makes them the worst humans. It’s a dog-eat-dog world, so they think it’s not unethical to have a few casualties just to keep moving ahead.

Unless they realize this deep-seated issue and break out of the spell, nothing can be done to bring them back to who they were earlier as human beings with empathy.

Of course, there is the last set of employees who are more or less invisible in this chaos. Essentially, they are not interested in any promotions, ESOP, or bonuses. They just want to survive every year till the date of retirement. They are normally placed in such a position that their work profile is not that important but the company needs some labour to do it.

They are not a threat to their peers or bosses. They are sweet with everyone and do any random task assigned by the bosses. They are also not worried about changes happening at the top management level because they are experts in changing their loyalties, as the weather knob on top of houses changes its direction with the wind.

“Have you ever played hanging to the roots of a Banyan tree in your childhood at your native place? It requires skills to hang on a root, but jump to another root at the right time before banging on the ground along with the previous root.” My friend interjected my thoughts.

He said, “See, as far as I know, you don’t have all these boot-licking and politicking skills and are therefore not among these special sets of trapped employees. So with that cleared, let me share some groundwork you need to do.”

To be continued…

Chapter 3

After surveying all kinds of our peers wanting to move out of the corporate humdrum, it was time to come back to my own case and deeply understand my situation.

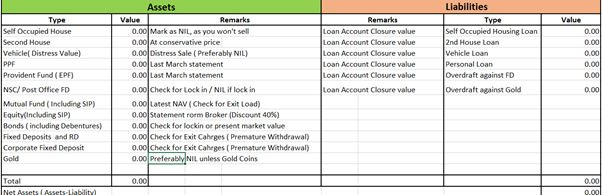

I scribbled my finances from memory on a One Sheet document and requested my friend to first look at the various heads under which I was trying to put Assets and Liabilities. He was happy to have a look and asked him to mail in my Excel draft. I did as asked and we had an extensive discussion on it.

“So you’ve mostly got it right.” He said.

“Let’s start with Assets…”

1. Self-Occupied House: You should be putting a NIL value for the same, as you are not going to sell it anyway. This remains constant even if you decide to take early retirement. So this asset does not have any value as of now for your early retirement planning. But at least on the Liability side, your outstanding loan will have to be considered until you foreclose it.

2. Second House: In this case, you need to check for the distress value. Remember, the property is not a liquid asset and may take a longer time to liquidate it. To arrive at the best-case scenario, you may try to contact a few brokers in that area. They generally start with rock-bottom prices only. You may look for the latest deals on a similar property in the neighbourhood to have some fair value. The location of your second house also matters so hopefully, you’ve been smart enough while investing in that bucket.

3. Vehicle: To be more practical or realistic, you should put NIL value for this asset, too. But if you and your family members can live without it, then, by all means, you can still assign a value to it. But I will advise against selling it as it would be illogical to sell the depreciating asset. On a cautious note, you may have to put aside your wish for a more expensive vehicle for a few years after early retirement.

4. PPF and EPF: You will get a statement for your last Financial Year to help in arriving at asset value. On the conservative side, put that value as per last FY and ignore interest and contributions accrued against it in the current financial year. You may add by computing it manually if you are at fag end of the current financial year.

5. NSC and other Post office investments: You will consider them only if there is no Lock-in period involved in those schemes. This may not be a liquid asset as of now. Consider it for its investment value even if it is not liquid.

6. Mutual Funds: You will get the exact valuation by calling the CAS statements from NSDL/CDSL. If they are under Demat, you will get their value in Demat balances. But, check for exit load if any, as the same may be debited from your final redemption proceeds.

7. Equity & Bonds if any: This information is easily available. But once again, I will advise you to discount the present market value by 30% to 40% to arrive at a conservative price. Most of the financiers give loans against shares in case required. We will look into the same in detail while computing your cash flow for early retirement planning.

8. Fixed Deposits & RD: You will have to take into account the penalty for premature withdrawals. In some cases of corporate deposit, you may encounter a lock-in period also. So, please check before arriving at fair value.

9. Gold: In the case of household ornaments, you may put the valuation at NIL. In India, very few people sell gold ornaments unless it’s the last option to survive. Even in the case of Sovereign gold bonds, there is a long lock-in period. Regular Gold ETF may have been already considered in the Mutual fund category. There are a lot of emotions attached to it. So, don’t consider the value of it in your early retirement plan. For the sake of our analysis, you can do a valuation of it, which is easily available at nominal charges. A loan against Gold may be an option if required in some emergencies.

Keeping in mind the end goal of doing this exercise for planning early retirement, we’ll have to see which assets need to be continued, and which assets need to be liquidated or replaced. Assets can be further looked at from the point of Assets generating positive cash flow (income) and Assets bleeding that is cash outflow.

Now on the other end, liabilities value can be easily arrived at, as you can get foreclosure balances from the Banks on requests. There may be some foreclosure charges (not in Housing loans) in some cases. Check for the same.

“So that should give you all the context you need. Let’s connect again after you are ready with actual numbers…” he said.

Apart from the Assets and Liabilities breakdown, he also wanted me to be ready with my monthly Income and Expenses statement, along with a laundry list of Yearly or Half Yearly major commitments like Insurance Premiums, Yearly maintenance, etc.

This meant I had to be very serious about my plan to exit the mess, which was, in all seriousness, a product of my own doings. I had never thought about the same earlier but better late than never.

He warned me that exiting the current job isn’t straightforward unless one has prepared for it from the beginning, and has plugged as many loopholes as possible. So having all your basic data at hand is crucial. This One Sheet should clarify your current commitments and future responsibilities.

The details should be known in advance and they also need to be well documented. Don’t be in a hurry but needless to say, ensure that you are delaying it too much either. You have to prepare yourself in such a way that whenever you do decide to quit, you can do it without any hesitation. But if you have not planned retirement properly, you may land in a bigger sh*t than what you are in now.

So take the proper time to prepare the Balance sheet and Profit and Loss statement.

He gave me some ideas for various headings under which I could prepare my statements. The most important statement he made was to classify your assets and liabilities into “Responsibilities” and “Nice to have.”

I was taken aback by the details that needed to be gathered before calling a day. I was glad I hadn’t decided to resign impulsively as I would have repented later.

“See I know you have worked in the credit department in your previous organization and you are also reasonably financially literate. This means you can read the Balance Sheet and P/L along with the cash flow statements of companies. Then why not read and interpret your own finances by putting all that knowledge to good use?” my friend said.

He pointed out that as I had dependents, it would not be a personal one-man analysis.

But I had to do it for my entire family, with the balance sheet and projected cash flow accounting for all our needs for at least the next 10 to 15 years.

“You are not alone and there are many stakeholders along with you. Your parents (if they are dependent on you), your wife (either earning or not), and your children (their future educational expenses, marriages, etc.). So all these responsibilities have to be converted into monetary value. Please take your spouse into confidence and discuss the pros and cons of your decision. Their cooperation is of utmost importance and he/she must be with you on your further journey.”

Also let’s not forget inflation, which needs to be accounted for while preparing the cash flow statement. Your future cash flows must take into account inflation, which is unavoidable. Lastly, whatever planning you will be doing must have the concept of “Risk management” embedded in it. For example, Medical exigencies of yourself and Family members.

This was turning into a fruitful exercise and I was excited about what we could discover ahead and so I thanked him for his valuable guidance.

“The next step could be preparing a cash flow statement for the next at least 15 years from the month of getting relieved from the duties. Remember, you won’t be getting that most awaited message (SMS) on the last working day of the month which is “Your Account xxx is credited with Salary.”

At this point, I had one simple doubt, “Why 15 years of planning and not more?”

He explained, “See, you are above 50 now and I’m thinking you may take 2-3 years from now to be ready to quit with a good financial plan. Assuming you have not messed up in your finances over the last few years and that there is no serious mismatch in Assets and Liabilities. Looking at your son’s age now, definitely, they will be more than settled by the next 10 years and may even support you. But, not depending on them, you should be able to survive at ease.”

He continued, “I hope there are no serious health complications, and you may be in a better position to take care of yourself. So your wants and needs will also go down drastically as you grow older and you slowly move toward Nirvana. The most important part is that, if you can survive for 15 years from now, you will have enough corpus to survive further.”

He said this would be a rigorous exercise that may need a month of my time. So it would be prudent to start immediately. He also promised to forward some model statements from where I could get some ideas about the structure of financial statements. But he advised me not to get restricted by his models and rather customize them to create my own style for preparing a detailed Excel sheet. This statement would not be a permanent fix and may need to be reviewed at certain intervals, so it was important to keep it scalable.

“One last step,” he said. “Don’t forget to read “Rich Dad and Poor Dad “again. You will have a new perspective now for reading it again.”

I could sense that it was going to be a long exercise. But the decision was made and there was no looking back from here.

To be continued…

Chapter 4

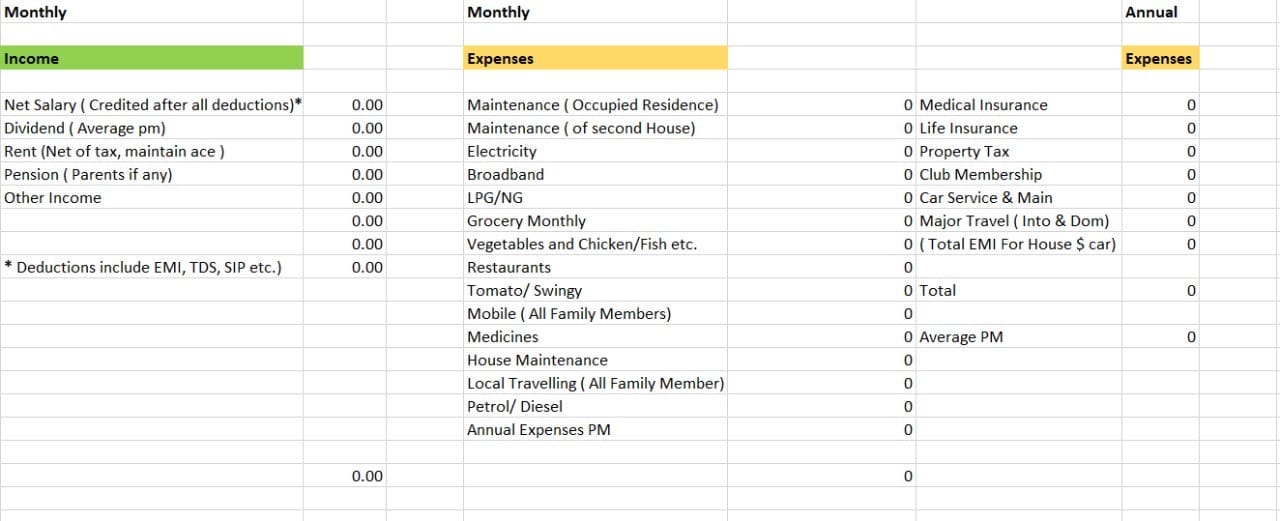

After the assets and liabilities, it was time to ponder over the profit & loss statements, or as we common folk call it, our household’s Income & Expenses statement. As always, the Home Minister and young Ministers’ thoughts and participation in the exercise were very much needed, and they agreed to take out some time for it.

The quickest available source of data was the bank’s detailed statement for the past few years, along with the Credit card statements, all available online with just a few clicks. As we scanned each transaction, we exchanged smiles and shocked faces trying to remember each instance when we had spent the money.

When we arrived at figures of Zomato/Swiggy bills and then Movie and Hoteling expenses, the kids shrugged their shoulders, anticipating some comments. But on a lighter note, I assured them that it may all still continue, as long as we plan it well. The worry on their faces disappeared, and we all had a hearty laugh for some time.

There was a long gap before we could continue the discussion, as I was very much occupied in a Half Yearly closing with Targets haunting me day and night. Of course, that motivated me further to stick to my exit plan. But as soon as, I got relieved from closing nightmares, I called my friend back. To my surprise, he said he was planning to visit Mumbai in the coming week. Thrilled, I invited him for a late evening dinner to take the conversation ahead over some chilled Heineken.

Definitely, it added more comfort for me to meet him in person for the first time since our “Mission Exit” started. I found him in great shape and in good health. He was looking very fresh and content.

“Wow, you’ve aged well since we met back at one of those award functions.” He nodded, grateful that early retirement had suited him well.

Diving in, he told me that my efforts were very good in preparing financial statements (for example, you can see my P&L sheet below).

“It shows your determination to execute the plan. But, we forgot to discuss, what exactly, you plan to do after taking Early Retirement,” he leaned forward.

The question hit me out of nowhere and I had to take a moment to think about it as I’d never considered that part at length.

My first instinct leaned toward the brighter romantic side of retirement. The “chill Zindagi” we all dream of having. Filled with all the activities we’ve always wished to do, like travelling, giving maximum time to family and friends, and so on… The bucket list is all the same.

“But what after that? How many years will you be chilling out? Listen, it’s not simple. Do you know what happens when a Lion or Tiger is released into the Jungle after being in a cage for the whole of its life?” He said.

I was relieved that he used the analogy of wild animals and not that of a donkey to get his point across.

He continued, “See, they are not used to the free world. They have been habitual in getting daily food at specific intervals. They do not have to hunt for it. Anyway, they have to perform acts in the circus or entertain people, if in the Zoo as per the HMV (His Master’s Voice). We’re all pretty used to dancing to the tunes of our Bosses to get a monthly salary every month, without asking for it. There are also the bonuses, ESOPs, Rewards, etc. which have been part of our awards. But all of that only if you perform well and make Management happy.”

Then comes the moment of truth.

“But, after exit, all this will stop and you will be needed to do something which will make you occupied. It’s not only money but your brain, which also needs to be fed with some constructive ideas, which keep it active. Your “chilling out at length will, in truth, make you vulnerable to becoming very lazy and this may affect your health. You will be bored within a few years, even if you somehow manage to survive financially. So, please think about something productive for yourself, which could be done with passion, help you stay active, and also give you some satisfaction. For instance, consider what could be done to add value to your life and to the larger social community. It may fetch money or not but will keep you busy in a better way. It can be joining an NGO or learning new skills (like music or sports), which you wanted to learn for a long time.”

Oh wow, I had never thought about all this. With a few pints in my belly, the thoughts started bubbling up. We both zeroed down on three things, which I could start doing right away. The First was starting a Travel Company. The second was establishing a small restaurant and the third was becoming Professional Trader.

“Good,” he said. He advised me that the first two options could be carried out through the Franchisee models also. It helps to settle down in business earlier and with fewer hick-ups.

But he was quick to warn me that I didn’t have a strong background or knowledge in those departments. Even with regard to my passions like traveling and eating out in restaurants, I admitted that I didn’t have a professional skill set to monetize them without a strategy in place.

So essentially, it was an infatuation, which needs to be converted into actual Love marriage.

“Remember, our great friend Krishna, who was one of the experts in selling Insurance and other financial investment products. We have no count of how many Trophies, and Certificates, he must have received. He was a regular member of RR functions abroad for qualifying in the contests.”

“Yes, I do remember. Who can forget his customer handling skills, which were learned by all of us?” I confirmed.

“Yes, the same person. But, he quit a year back, as he was sidelined by his bosses in ratings and promotion. In one of the meetings, he was humiliated for not achieving targets on Loans and advances, which was not his forte. He gave it back to the Regional Manager, who ensured that he was not only not promoted, but also further disturbed by being transferred back to a small branch. He immediately resigned and ventured out on his own.

He is now a Financial Planner and insurance agent, earning much more than his earlier salary. The funniest part was that he put all his trophies and certificates in a few gunny bags and sent them to the Regional Office after getting relieved from his duties, just to send a message.”

So the takeaway is that he was already skilled and knowledgeable in selling insurance and mutual funds. It helped him to start on his own without any gestation period. His close relationships with most of the clients also helped him.

Just like that, you too need first to get detailed knowledge and skills to start on your own.

The next 2 to 3 years should not only be about bringing your finances into a proper position but also about getting ready to take on new assignments of your own – do you know the best place to begin for yourself?

To be continued…

Chapter 5

We needed sufficient time to plan the next step of action. So looking at all the details, we started analyzing numbers and initiated the next leg of our discussion.

“So your monthly expenses without Annual or other commitments come to around Rs.75,000/- per month. Now to continue the same standard of living, we will have to confirm the cash inflow accordingly.

At the time of preparing the Final cash flow statement for the next 10 years, we will also be considering inflation.

Secondly, cash flow will also be required prior to certain large outflows on specific dates in a year like bulk commitments of Insurance premiums, Club Memberships, Property Tax, etc.

Remember, it cannot be a perfect matching of cash inflows and outflows but definitely helps time it if planned well.”

This brought us to the main question – from where these cash flows are going to come in the future?

“Is it possible to match your salary income with any other cash flows? No, definitely not … but there is a way. Your expenses too will go down after Retirement. This cash flow will be from your Assets, and it will be generated in some systematic way. But of course, we will need to eliminate the Assets which are bleeding your cash and depreciating over time.”

He moved on, “So let’s talk about investment in Property other than your own house. Before going ahead, I would like to know what insight or thinking went into your decision to buy that 2nd House in Kharghar 3 years back?”

I explained that the investment in that house was purely on the basis of expected appreciation in the property and some monthly income through rent. It was simply an investment to create Wealth for the children in the future. I did feel responsible towards them and their future.

“Ok, but how many years would you be holding this property for your children?” He inquired.

I was not sure and gave him a blank stare.

He explained that most of us in India take such decisions on the basis of emotions. This leads to buying of jewellery items and property in a big way. It’s a show-off during functions and similarly, we also feel a bit proud of holding various properties. Yes, there are professional Investors who understand how to invest in property and exit with good returns. It is their core business. Their Money story is different. We’re not one of them.”

Let’s do another exercise. Let’s analyze the decision to invest in properties in comparison with other classes of Assets.

“As per the data available, the Average price increase (Cost of Real Estate Inflation) has been 6% to 7% for the last decade. The highest growth was in Pune and then Bangalore, in the range of 50 to 60% over the period of 10 years.

As per your data, Investment in the Kharghar property was 80.00 Lacs (including stamp duty, Brokerage, etc.) and the current value is nearly 95.00 Lacs. The total returns work out to be 18% in the last 3 years; which is 6% per annum. Now, compare it with the Equity Market.

The BSE Sensex, India’s oldest and most popular stock market index, has given a return of 15.50 per year in the last 10 years. The rise is from 15800 to 40130 in 10 years. The Mutual Funds’ average returns per year are 15% per annum. Also, the average return on Gold (Bonds, not Jewellery) is 10% per annum.

After charting out these figures, he said, “So the most important decision you may have to take is to exit from the second property and move to a more profitable Asset. We may look for good combinations of schemes with some goals and your Risk profile in mind. I know that being an Indian at heart, you will be shocked by this new suggestion. But let’s see the rationale behind this decision.”

—

Risk: “Investment in Mutual Fund is Risky, Please refer to the offer document before Investing.” This disclaimer bothers us a lot right?

Cool, then just google and find out which Mutual Fund company went bankrupt and the Investors lost their entire Money.

You may come across many cases of incomplete Real Estate projects for indefinite periods or properties being declared unauthorised in the future. However, in the history of registered and trusted Mutual Funds, there has never been a time when the value of a fund portfolio has dropped to zero.

Yes, returns can be negative in the short term if there is a drop in the overall market. In fact, check how many times the stock market has gone down significantly and what happened to it after a few years. (Hint: It always bounces back).

Why look at the long term? Remember that your investment in MF should always be for a longer period (min. 5-7 years horizon), without which it will not yield anything significant.

It’s foolish to check your MF investments every morning and worry. After all, we don’t call our property brokers every day to know the value of the property each day, or for that matter, nor do we call the Branch Manager for knowing how much interest has been credited to your Saving Bank against your FDs.

Returns: The data is very clear to tell that Average Mutual Fund returns are much higher than Property appreciation over a longer period. The best Mutual funds have given 22% returns over a long time. Now let’s check the returns from the rent you get from your Kharghar property.

- Value of Your Kharghar Property (2 BHK): Rs. 95, 00, 000/-

- Rent: Rs. 22000/- p.m.

- Less Maintenance: Rs. 3000/- p.m.

- Less Property Tax: Rs. 1200/- p.m.

- Tax (if you are in 30% slab): Rs. 7200/- p.m. ( 33% with cess and surcharge

- Total Returns: Rs. 10600/- p.m. (That is Rs. 1,27,200/- p.a.)

So here the returns are 1.334% p.a. (also note that the Loan EMI is not considered, which is Rs. 38000/- per month on a 50.00 lacs loan to be repaid in 20 years and considering 6.50% interest.

Do you know you will be paying nearly 43.00 lacs as interest to the bank over a span of 20 years? Will you add this as a cost in your acquisition value of the property? So with that in mind, what are your returns?

Over 20 years your property will be valued at 4.42 CR – that is if we consider an 8% rise per year. Now imagine if you hold the same 95.00 lacs in various types of Mutual funds. And consider the worst performance of 12% over for next 20 years (you can check the best and bottom-most performances of MFs online), and then calculate the value of the Investment will be 9.16 CR.

“Now, tell me how much net worth you will have created for your sons and daughters?” He asked.

It was clear that the property option was less appealing.

We have not even considered the cost of Stamp Duty expenses, Brokerage, Flat remaining idle between the period of getting a new tenant and exit of the old tenant, and Time & Energy wasted in running behind the Broker. What about the most important fear of damage to the property by the Tenant and any other legal issues one may face in case of any disputes that follow?

So considering all this, even if you wish to add rent as these returns in property appreciation, they are nowhere compared to the returns of Mutual Funds.

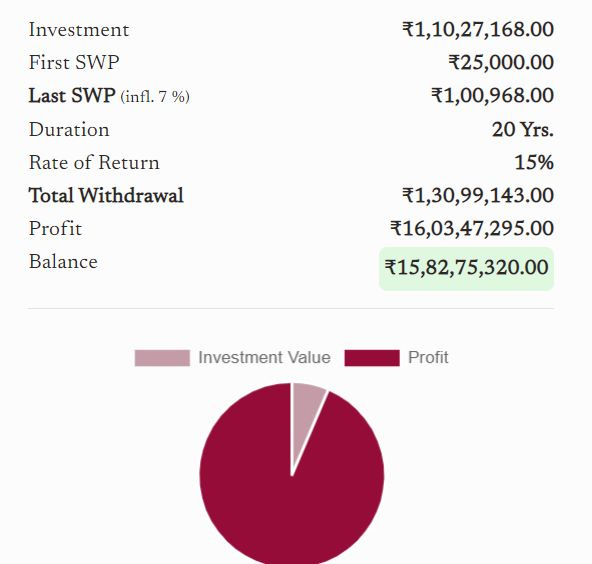

Now regarding our monthly returns, we will discuss in detail the option of SWP (Systematic Withdrawal Plan).

This will yield much better returns and is going to be the most important cash inflow per month for you, after retirement.

Liquidity: You already know that Mutual Funds can be redeemed within two days (T +1) working days in case of the urgency of funds. Now, think of selling your property in a month, in case of urgent need of funds.

It takes at least 3 months to dispose of the property in the best-case scenario. The funds also come in a staggered manner. And, if people come to know that you are in urgent need of funds, you will be screwed and it will be a distress sale.

Divisibility: Have you ever heard of selling one room, or just the kitchen part of your residential property, in case you are in need of funds? But in the case of Mutual Funds, you can redeem any number of units to suit your needs. Also, you need large funds to invest in property, but in the case of Mutual Funds, you can start investing from Rs 500/- p.m. onward.

Tax: Your rent from the property will attract tax according to your income slab. In the case of Mutual Funds, it’s Short Term and Long Term Capital Gain Tax. The first 1.00 lac profit per annum is tax-free. There are ways to bring down taxes with some manoeuvring like carrying forward losses or switching of funds.

Definitely, you will need experts but they are available easily now to guide you for such investments. Are you aware of changes in income tax benefits on interest and principal amount of the Housing Loan for the second house? The Cap is always there for tax exemption amounts under relevant sections.

Diversification: In Mutual funds, your money is invested in various securities like Equity (in different companies for further diversification), Debt, Government Securities, etc.

Your Money in the property is concentrated in one Asset and you have no option to diversify it. But in Mutual funds, we can diversify in different schemes as per your Risk Profile.

—

“So all these points considered, the truth should be evident in front of you,” my friend rested his case.

“You can take a second opinion if you like. If you agree, then we will be having the plan to reduce your outstanding Housing Loan and be ready to sell the flat within the coming year.

We will discuss how the Capital Gain Tax on the sale of the property can be reduced, and shifting to Mutual Funds will still be much better and more profitable. Definitely, you can take your CA in confidence on this matter to have a second opinion.

He shared some links which I’m attaching below.

Further Research:

- https://www.finlive.in/page/swp-calculator – For my case, we assumed we’re investing 95.00 lacs for 20 years in MFs with an average 15% return and 25,000 monthly withdrawal as part of the SWP (Systematic Withdrawal Plan). We considered initiating withdrawal from next year and inflation of 7%.

To be continued…

Chapter 6

When I started this conversation, I never imagined it would lead me and my family to rethink entirely how we looked at our money and lifestyle. All the pieces had fallen in place and a glass of beer gave me the impetus to consider the plan sealed.

This time, we took a flight down to Goa, partially to soak in the fresh breeze and in part to put our plan into motion.

I caught up with my co-guide, who had kept me motivated to see this journey through to its end. Plunking down in the resort’s lounge, we spent the afternoon freezing on the cash flow statement for the next decade or so. He was pleased to see both my sons step in with good financial knowledge and a keen interest to be involved in the process.

I thought it would be good to make my sons understand that what we’re doing would benefit them in the long run. So I broached the topic, agreeing that it’s generally difficult for anyone to digest the suggestion of disposing of the second property and investing that capital in Mutual Funds. We middle-class people always have a dream of creating assets for the next generation, and once we have something physical to pass on, we feel that we’ve carried out our responsibility.

My elder son smirked at me and said, “Pappa, I’m already so grateful for what you’ve done for all of us – I couldn’t possibly expect anything more. You’ve helped us get a good education and your support in the initial phase of a career is more than enough. Now, it’s time to relax, do whatever you dream of doing, and look after health and peace of mind.”

Patting his sibling on the back, he confirmed, “We’ll build my own empires very soon and make you proud.”

My friend was glad we were talking about this.

Raising his glass, he said, “I wish more people discuss financial plans with our family like this. We don’t do that anymore, do we? But do they really want us to slog in the worst working environment and ruin our health & self-esteem? I’m sure that’s not the case. So the onus of having this discussion and empowering them is on those of us who understand its need.”

Narrating his own story, he continued, “When I was back in the humdrum days, I remember requesting a leave from work because my wife needed me to be with her for some important event. When I raised the request to my boss, he bluntly refused it, shamelessly threatening my job, and taunting me to ask my family if they still needed that monthly paycheck coming into the bank account.

Like the age-old story of “Valya Koli,” we all should ask our families, “Are they okay with us bearing the huge senseless pressure and humiliation of our worth?” I don’t think anybody would want it for anyone.

Of course, it doesn’t matter if you are enjoying your role, and the working environment around you is highly conducive. If you don’t need to boot-lick your higher-ups or ruin your mental health, and if you think this will continue to stay the same in the long run, then by all means, then it’s wise to keep your bets on the corporate track.

But when your boss pushes for a toxic environment, expecting you to pressurize, humiliate, and burn out your subordinates just to squeeze in a better performance figure at the end of the year, then it is time for you to realize that you do have control to get out of this decision, only if you start planning now.

I added to my pal’s point, “Phew, the decision is made. I was lucky to meet you, who showed me the way out and will help me to live with dignity. I hope all who are sailing in the same boat as I find such a support system. This lesson was not only for me, but my entire family became financially literate. They all participated in this exercise and learned simple financial jargon with me. If not now, then in the future, it will help them to build their own empire with simple rules of investing.”

Smiling at my kids, I said, “I have only one piece of wisdom to pass on to you – Invested Raho! Don’t panic. Don’t submit to the highs and lows of the market. Just stay put and watch your seeds bloom into trees over a decade. Invested Raho – Sada sukhi raho!”

They laughed and agreed to follow the pragmatic route.

If you find some sense in what I’m trying to share here, you may find this roadmap helpful.

First and foremost, we need to start by securing our Life and Health, We normally remain careless about Health Insurance policies, as our Employer is taking care of it.

But, what about after the superannuation?

Will any company insure you at that age?

So it’s better to cover yourself at your own expense at right time with the best Health Insurance coverage to get benefits in the later period of your life. Startups like Ditto (by Finshots) provide reliable advice for this for free online – do Google the name.

Also on the other end, do have a conversation with your employer’s insurance partners.

Check whether they will continue the policy after your exit from the company. You will have to pay a premium after leaving the job, but the policy may still be in force on paying a premium from your own pocket.

But, remember, every year your company negotiates with Insurance Companies, and the continuation of your policy may not happen. So err on the side of caution and cover yourself as well as your dependents at right time.

The second most important action we planned to take, and I urge you to do the same, was to discontinue all “Bhel puri” life insurance policies. It is a very debatable subject: Is clubbing investment and life insurance in one instrument good for the customer?

My friend nodded furiously in denial.

He raised a valid question, “Do, you know, how much amount is actually invested from your initial premiums?”

Suppose you have paid 1.00 lac as a premium for some ULIP plan and got a nominal cover of 10.00 lacs. The total commission and administrative expenses can be debited to the tune of 40% to 50 % of your premium.

Then comes Mortality charges for that peanut life cover. These charges get debited on consecutive premiums, though debits may be less than the first premium.

So how much exactly of your total amount is getting invested? Do go ahead and ask for a detailed statement from the agent or bank staff who has marketed that scheme to you.

As you’ll discover in the statement you get, it’s not a wise idea to mix Coffee and Tea. Enjoy them separately as per the time of the day. Take a good cover with Term Life Insurance and leave investments to other, more tried & test assets like mutual funds.

I then called for surrender values of such policies and was shocked to see that value was just above the total amount of premiums that we had been paying until now for the last 5 years. The only logical option was to divorce Insurance and Investment.

This being said, remember that Mutual Fund investments should ideally not occupy 100% of your total Asset Allocation. Never put all your eggs in one basket, as they say.

With my friend’s and professional advisor’s expertise, we put together a diversified pool of investments, spread across classes like Equity shares, Mutual Funds, Fixed Deposits, Corporate Deposits, Sovereign Gold Bonds, and NSC.

The share of each asset was as per my risk profile i.e. how much I appropriate would it be for me to invest in high-risk assets. You can get your risk profile generated from any certified professional just by answering a few basic questions about your needs and plans.

In my case, the assets were divided into two parts, one giving me regular returns per month and the other part creating wealth through slow but steady long-term growth. A small portion of assets was set aside purely as a growth fund, which would be synced to match and give me returns for my major commitments in the future like my son’s higher education, my bucket lists of international tours, etc.,

Will this work? Yes, with good planning, of course!

But what’s the catch – what can go wrong? That’s the point of financial planning – it helps you account for all possibilities. Let me explain.

For starters, if you or someone in your family faces a health emergency, the cover is already taken so that’s sorted.

You may have an early exit to heaven, in which case the life insurance will take care of those whom you’ve left behind. In fact, if your family is financially literate, they will surely manage the show even if you are not on stage.

And what about the equity market – it may crash, right? Yes, it can.

How many times has the market crashed in the past? Let’s do a quick rundown.

2008: The market corrected heavily due to the subprime issue and the fall of the Lehman brothers in the USA. Nifty 50 went down to 2885 in Oct 2008 from an all-time earlier high of 5140 in June 2008. That was scary, the Nifty was again above the previous high and touched 5870 in November 2010.

2010: There was a correction again due to the economic crisis in the USA and European economic conditions. The Nifty had a fall to 4625 but was much above the previous fall of 2885. In the next 5 years, it doubled to 8500 by March 2015.

2015: There was a heavy correction in the Market due to Demonetization and then the GST Market touched 8600 from 12000 in a matter of 3 months. But, did it fall below an earlier low of 7000?

2020: This was one of the steepest falls in the Market, as the Pandemic hit the world from nowhere. In the span of just 3 months, the market corrected from 11962 to 7511 before closing to 8597 in March 2020. What happened thereafter, the Market made an all-time high of 18604. It happened in just a matter of 22 months.

Notice a pattern? Wait. I’ll point it out.

So then what are we scared of? Just surf for the image of the Nifty chart from left to right since it began. What do you see? It’s up and up. Yes, there are dips. But the market has always been positive on the longer time frame. Corrections are part of the game.

So, as my third recommended action for everyone, don’t take any action! Just stay relaxed and have patience. It’s not a gamble, it’s a smart investment. Understand the difference.

Learn the investment strategies through Professionals or just consult experienced experts from Mutual Fund Houses. I am sure that over a time period, your fear will recede and your share of investments in Equity and MF will grow in your total Assets portfolio.

Last but not the least, a fourth step would be the precautionary measure. Continue building your winter fund or a safe exit plan. As decided, you will need to have 12 FD receipts of Rs. 1.00 lacs maturing on the first of every month after your voluntary retirement. This will act as a cushion and help you to adjust to your new lifestyle. By the time this support gets withdrawn, your new assets will start giving consistent returns. Let’s come back to review it every 6 months.

Our Goa trip ended on a high note as we all started seeing the changes in how we look at every rupee that flows through our four walls. I thought the story is worth sharing because I know every family in India struggles with the same situations and questions, and it’s only a matter of some of us taking the lead and supporting each other.

But of course, that’s the only thing we can do – share our advice and expertise. Taking action is a step that’s entirely in your control. For anyone who’d love to chat up more on this, and also gets access to the resources or templates I used to chart out my financial life, my DMs are always open for curious friends!

Leaving you with the encouragement to think ahead if you want to get ahead.

Yours in growth,

Bhooshan