When it comes to wealth, it also has a lifecycle as humans themselves have. Broadly, there are three important Lifecycles in Wealth.

- Wealth Creation

- Wealth Preservation

- Wealth Transfer

A typical lifecycle start for any person is childhood, Education, and then Job or self-employment. After that, He/ She builds up wealth till the age of 60 (or for that matter, it could be 50; in case the person wishes to retire early).

After reaching that golden age, the only concern remains how to protect/preserve the wealth to sustain post-retirement life. Everyone knows that Death is uncertain but along with it, one more uncertainty comes. That is for how many years you are going to live. The third stage of making a wealth transfer also comes into the picture.

We all know that we cannot take our wealth along with us to our final destination. Hence, your requirement for assistance from a professional in these stages depends on which stage you are in now.

Wealth Utilization is about prudent spending & transfer is about being alert enough to plan for your next generation. But wealth creation is where most of us get stuck, so let’s focus on that stage in detail.

1. WEALTH CREATION

We’re always trying to sustain ourselves with new income, so this phase lasts us for our entire lifetime, but the most critical period is from 25 to 60 years. Of course, that can change from profession to profession – a medical professional’s career may start later but quickly gain traction because of the ROI.

The funny thing is that we have max energy in our 20s & 30s to accumulate wealth but this is also the age where we have the highest spending capacity. There’s always the urge to splurge on luxuries & lifestyle items.

As our income increases, there’s also the tendency to treat it casually until it all breaks down & we get alert.

But as someone who’s been through all of it, retirement planning is most successful when you start from your first salary (or profitable month of your business). If you’re on a salary, your employers may have put up an EPF provision or offered ESOPs, but relying too much on these perks is a slippery slope.

Because employers cometh, employers goeth.

We join the rat race to show off our status & treat the art of “saving” as an old man’s job when in reality you are most vulnerable to issues like job loss or market crashes at this age (since you haven’t yet built up enough wealth).

Take the recent wave of tech layoffs or the COVID-19 pandemic – people have lost everything with no ground to hold on to because they didn’t plan for it.

I don’t mean to scare you, it’s always better to start today than later. So could you talk through a financial advisor, make a plan, and stick to it?

Mutual Fund SIPs, bonds, long-term equity building – these are simple ways to start building pockets of wealth. There’s no age or income restriction for them but you have to keep adding to these pockets consistently to get results.

I realized all this at a later stage in my fifties. But as soon as I caught the drift, I made & followed a 5 years plan, which allowed me to exit the toxic corporate environment & transition into retirement where I’m now doing what I love – learning about money, and guiding people on it.

On a side note, remember that wealth isn’t just the money in your bank account.

1A. SOCIAL WEALTH – This is your network. You’ll realize that as you grow old, finding quality people to learn & grow with is difficult. So actively seek them out & make connections with a positive attitude towards life.

Take out time for your family & find friends who discuss solutions & ideas rather than complaining. You will treasure these networks most when you grow older.

It’s just like any form of investment – the ROI is worth the effort.

1B. HEALTH WEALTH – What are you going to do with a million dollars at 40 if your body can’t support you? If you’re not physically fit & mentally happy enough to travel, what’s the point of making so many travel plans?

Invest in your health every day. Eat healthier (a couple of cheat meals every month) Get a trainer. Fix a time for the gym or a brisk walk. You’ll see immediate results in your mindset (it feels so refreshing!) but more importantly, you’ll thank yourself for it when you notice all your older friends start developing heart & back problems in their 30s.

1C. INTELLECTUAL WEALTH – The skills you acquire play a crucial role in deciding when you can quit. Having skills gives you leverage. To choose jobs you love. To choose jobs that pay well. So invest an hour in becoming a T-Shaped (master of one, jack of many) people – companies & business clients find such dynamic people highly valuable.

Weal Creation is the most important phase, as any lethargy or lack of financial acumen will lead to an increase in this phase beyond retirement. Sometimes, it becomes an exercise for a lifetime, if it is coupled with a careless approach continued in the wealth protection phase also.

Here comes the crux of retirement planning, which starts as early as your first salary. The biggest mistake that happens at a young age is accumulating liabilities with huge housing loans, car loans, and credit card expenses.

No one is advocating that you should not buy a house or car. But the source of money should not be from huge loans but mostly through investments. so, in this phase of wealth creation, it is important to build the assets, which will yield income in the future.

One of my friends argued that if everybody starts thinking like it, how the economy will grow; which depends on consumption. So, my reply is that you should help the economy by building Assets and paying taxes. Let others splurge money for your benefit.

At the age of 25 itself, you can start building a corpus for your dream home to be bought at the age of 35. A 10-year plan can help you to build a sizeable amount as your own contribution and reduce the component of a Home Loan even if that option is still needed. But, what if the prices of properties go up, definitely your salary too will rise and your contribution toward corpus building also increases.

Wealth Accumulation & Utilization

The Wealth Creation Phase brings with it two more core concepts. If wealth itself is not created, there is no relevance to the next phase.

What do we fear most? Death? No, but the uncertainty of living more after retirement. In that phase, our wealth creation capacity reduces, and the cost of living increases. Hence, Planning at the pink age is critical.

Due to cultural changes, the period for wealth creation is getting squeezed on a yearly basis. Due to the availability of funds for Higher education and mushrooming of professional institutes, many young graduates prefer to opt for post-graduation or professional qualifications.

This increases the period of education. On another side, with the work pressure and uncertainties due to layoffs, working after 50 has become stressful. Everyone dreams to retire early. But. The question remains, have you planned for it? As your age grows, your priorities change. Self-respect and peace of mind take precedence over money. Unless you have planned well in that crucial period of age 30 to 50, you remain a slave till being kicked out or reach superannuation.

So, “Mantra” is simple for persons in the age bracket of 30 to 50….

Start investing (not saving), in various assets like Mutual Funds, Equities, Bonds, and FDs (for short-term liquidity). Don’t create Assets (unnecessary lavish houses, dream second house, swanky cars) by creating huge liabilities. Create Assets, which will give returns in the future and not jitters ….

Goal-based financial planning with cash flow plays a major role in Retirement Planning.

A simple calculation:

Wealth Accumulation Phase: A SIP of Rs 10000 PM at the age of 30 for the next 20 years (with an increase of 10% PA) & Expected return of 12.5% will result in 2.48 cr at the age of 50 years (Early Retirement Plan). Many SIP calculators are available to confirm the same.

Wealth Utilization Phase: Now at age 50, you invest at least 1.50 CR (from SIP Corpus) in Mutual Funds with expected returns of 10% on a conservative basis and hold an investment for a year.

You can easily start withdrawing Rs 1.00 lac PA for the next 20 years through the SWP route.

Definitely, your other investments like PPF, Gratuity, etc. will help to continue to grow, if invested in other assets like FD, Senior citizen schemes, and so on…

Instruments for Wealth Creation

In simple terms, Wealth Creation is a journey from SIP to SWP. There are many investment products, which can help to build assets for retirement as well maintain the same lifestyle after retirement.

Mutual Funds: At a young age, individuals can start with aggressive funds (as risk-taking ability is more at that age). The best strategy is the transition from aggressive to debt funds as you approach retirement.

Life insurance clubbed with the investment is another product, which comes into the picture, as your income starts growing and you have dependents. But, is this an Investment product or a Risk management product? This is the biggest blunder done by many.

Recently, I came across a case, where a 50-year individual had taken an endowment policy for 15 years from a leading public insurance company. A hefty premium needs to be paid per year and he was never told that accrued bonus can be paid only after 15 years and not before it. So, the biggest criterion of liquidity was compromised.

Though he had mentioned his requirement to an agent about the need for funds for his son’s post-graduation, the agent went ahead with this policy. Now in case of emergency, when he wants to liquidate the policy, he will get a surrender value much lower than his paid amount to date. Now, he has no option but to pay the premium till the age of 65, even if he may have retired much before that. So from where this premium will be paid? Of course by breaking FDs and other liquid investments.

The funniest part is that the agent is advising him to take a loan against the policy at an 8 to 10% interest rate. Isn’t it a Trap now? Moreover, the actual return after 15 years will be 6%, as much of the earlier premiums were not invested by the company but went into the black hole of agent commission, administrative expenses, and mortality charges.

So, friends keep Insurance and Investment separate. Become financially literate to understand, why and where you are investing. Is it to attain your Goal or the Agent’s goal? Remember, the commission is highest in ULIP and Endowment plans, and they are the most aggressively marketed.

What factors should a Wealth Creator consider?

There are many factors you have to keep in mind during this stage.

1. Timing of Investment:

Starting early is half the work done. The best time to start investing was when you got your first pay cheque. We all know about the power of time and the power of compounding, which can do wonders.

2. Aggressive approach in the beginning and the tapering to balance:

Frugality and minimalism are very important in today’s world. Instead of spending on riches & luxury, it’s always better to spend on upgrading yourself, learning, setting up side-business, and saving/investing in appreciating assets at the very least.

3. Asset Allocation is a must:

A typical household in India today has huge exposure to real estate and gold, occupying almost half of all the wealth. The other half is in financial assets where again bank deposits, government small saving plans, insurance investments, etc. garner a large share.

The lowest exposures are towards equities and mutual funds – the products that are crucial to exponential wealth creation over the long term. We enter markets when it is late and exit early.

4. Diversification helps, but only to a certain extent:

We all know that diversification reduces the overall risk of your portfolio. But too much diversification into too many asset classes, products, etc. would also mean that a lot of underperforming assets sneak into your portfolio. You can’t really make good money betting on all horses in a race.

5. Wealth creation should be followed by wealth protection, too:

All it takes to wipe out your wealth is one unfortunate moment or event in a lifetime. We can’t control what can happen in life, although we can be careful. However, we can certainly control the financial repercussions originating from unfortunate events such that our financial well-being is not compromised and we are not left at the mercy of fate.

Having proper risk management like insurance is one sure-shot way of minimizing financial losses and suffering. There are many products out there, both personal and non-personal, which can protect us financially.

Explore products related to life, health, personal accident, critical illness, home, motor, fire, travel, shopkeepers, professional indemnity, etc, to minimize your financial suffering. The other way to minimize financial risks in life is not to take unnecessary risks (avoidance) and huge bets.

6. Build your skills and ensure multiple sources of income:

One thing very common in all self-made millionaires is that they take themselves seriously. They are clear on what they want, they are focused and passionate, have built good habits, have strong character, and displayed behaviour in line with their image and goals in life. They are always learning and acquiring new skills.

How to Plan Wealth Creation

But for people aspiring to retire early, it could end at 50 also. This period continues to be very crucial, as it builds a strong financial position later to take care of yourself and your family post-retirement.

It requires a strong financial plan and some number crunching to be done to create a solid financial plan. So, how to start?

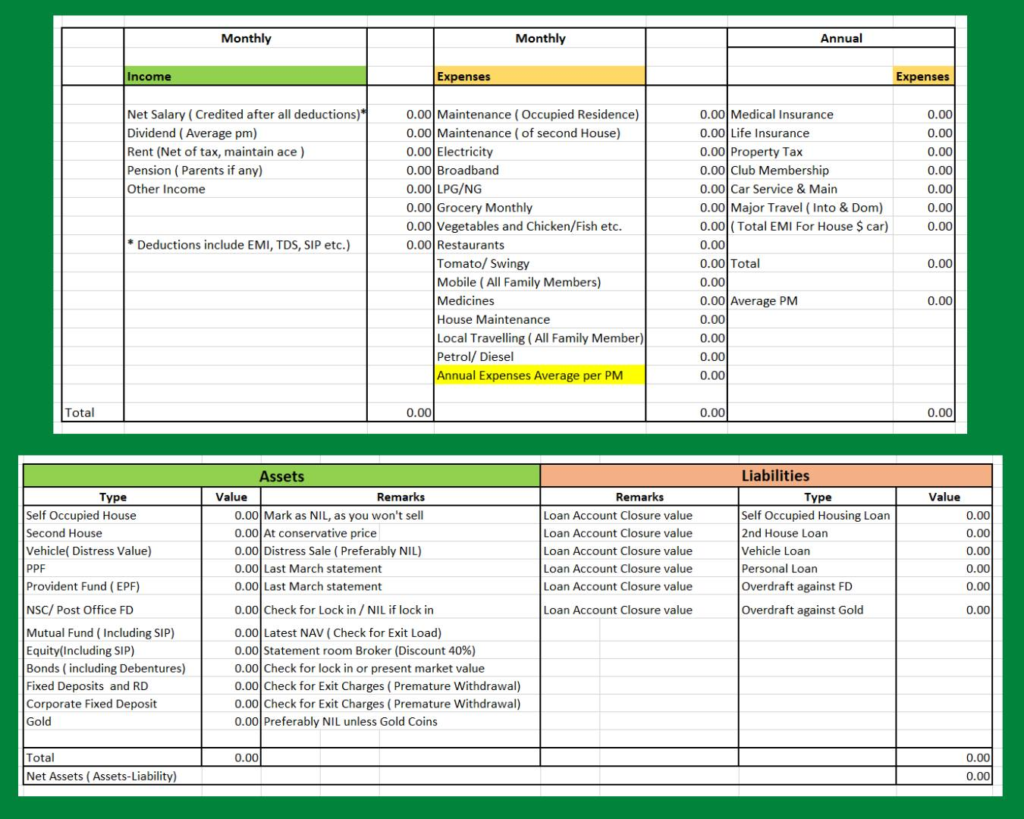

The first and most important to be done is to create a Monthly expenses statement, which should also take into consideration all major Annual expenses.

This Annual expenses can be added to the monthly statement by dividing them by the number of months. This will throw light on, what is exactly happening with your money. It will tell you, where your one Rupee is coming from and where it is getting spent.

Don’t worry, if you come across some shocking insights which you may get from this process. But, congratulate yourself that at least, you have found the bottlenecks towards your financial freedom.

Preparing such Income statements with sincerity and in detail is the first step towards Financial Freedom. Needless to say, the exact facts and figures are reflected in the statement.

We always inform our Medical Consultant about the exact problems we are facing with our health so that the right diagnosis and the right solution are available.

Similarly, there should be honesty and sincerity; while preparing such statements.

In addition to Income expense statements, you need to prepare Asset and Liabilities statements as detailed below.

Both these statements may act as a financial horoscope for your further plan. A good Financial Advisor can prepare a road map for your financial plan based on the data provided by you.

Conclusion

So what’s the next step? Well, I’ll continue updating this article with new insights on the other two stages, too, but I hope by now, I’ve given you ample to think about Wealth Creation at least.

Call me at +91 98203 01288 to share your thoughts!